Perkerson Civic Association

GA Leads Nation in Bank Closures

********** Got a Vacant House sitting around you **********

Each depositor insured to at least $250,000 per insured bank through 12/31/2013

Is My Account Fully Insured? [Click Here]

You might wonder why I have written information on bank closures. Well, that vacant house that is a nuisance to you and your neighbors might have come about when someone went through foreclosure. Then, financial institutions failed which means that FDIC walked in and shut them down. By the time this happens, trying to find owners of properties presents a major search task for local governments as to who owns the property. Many times, these vacant properties are showing up under FDIC or Fannie Mae or Freddie Mac. Nowadays, we have the internet which makes it easier for FDIC to sell the banks or financial institutions before they walk in the door. So, take the time to understand how things happen around you because you never know; it just might be your bank next.

For more information about the FDIC, or to use the FDIC's Electronic Deposit Insurance Estimator (to determine whether you have adequate FDIC insurance) visit www.fdic.gov.

_____________________________________________________________________________________________________

Latest Bank Closing Information - June 18, 2010

Nevada Security Bank, Reno, Nevada

**********

- Is My Account Fully Insured?

- Complete Failed Bank List

- Failed Financial Institution Contact Search

- Bank Failures in Brief

_____________________________________________________________________________________________________

Georgia Failed Bank List

_____________________________________________________________________________________________________

Bank Name |

City |

State |

|

Closing Date |

|

|

|

|

|

|

|

Saint Marys |

GA |

|

May 14, 2010 |

|

|

Cartersville |

GA |

|

March 26, 2010 |

|

|

Carrollton |

GA |

|

March 26, 2010 |

|

|

Hiawassee |

GA |

|

March 19, 2010 |

|

|

Ellijay |

GA |

|

March 19, 2010 |

|

|

Duluth |

GA |

|

March 19, 2010 |

|

|

Cornelia |

GA |

|

January 29, 2010 |

|

|

Carrollton |

GA |

|

January 29, 2010 |

|

|

Atlanta |

GA |

|

December 18, 2009 |

|

|

Reidsville |

GA |

|

December 4, 2009 |

|

|

Norcross |

GA |

|

December 4, 2009 |

|

|

Atlanta |

GA |

|

December 4, 2009 |

|

|

Sparta |

GA |

|

November 6, 2009 |

|

|

Lawrenceville |

GA |

|

October 23, 2009 |

|

|

Atlanta |

GA |

|

September 25, 2009 |

|

|

Newnan |

GA |

|

August 21, 2009 |

|

|

Atlanta |

GA |

|

August 21, 2009 |

|

|

Gray |

GA |

|

July 24, 2009 |

|

|

Perry |

GA |

|

July 24, 2009 |

|

|

Macon |

GA |

|

July 24, 2009 |

|

|

Woodstock |

GA |

|

July 24, 2009 |

|

|

Alpharetta |

GA |

|

July 24, 2009 |

|

|

Suwanee |

GA |

|

July 24, 2009 |

|

|

Winder |

GA |

|

July 17, 2009 |

|

|

Newnan |

GA |

|

June 26, 2009 |

|

|

Villa Rica |

GA |

|

June 26, 2009 |

|

|

Fayetteville |

GA |

|

June 19, 2009 |

|

|

Atlanta |

GA |

|

May 1, 2009 |

|

|

Kennesaw |

GA |

|

April 24, 2009 |

|

|

Atlanta |

GA |

|

March 27, 2009 |

|

|

Stockbridge |

GA |

|

March 20, 2009 |

|

|

Commerce |

GA |

|

March 6, 2009 |

|

|

McDonough |

GA |

|

February 6, 2009 |

|

|

Duluth |

GA |

|

December 12, 2008 |

|

|

Jackson |

GA |

|

December 5, 2008 |

|

|

Loganville |

GA |

|

November 21, 2008 |

|

|

Alpharetta |

GA |

|

October 24, 2008 |

|

|

Alpharetta |

GA |

|

August 29, 2008 |

|

|

Alpharetta |

GA |

|

September 28, 2007 |

|

|

Atlanta |

GA |

|

September 30, 2002 |

_____________________________________________________________________________________________________

INVESTING ANSWERS [http://www.investinganswers.com/node/996]

_____________________________________________________________________________________________________

The following information was taken from the website INVESTING ANSWERS Articles.

______________________________________________________________________________

Federal Deposit Insurance Corporation (FDIC)

______________________________________________________________________________

What It Is:

The Federal Deposit Insurance Corporation (FDIC) is an agency of the U.S. government that insures deposits in banks and thrift institutions, supervises the risks associated with these insured funds, and limits the repercussions on the economy when a bank or thrift institution fails.

The FDIC was created in 1933 as a result of the bank failures that occurred during the Great Depression.

How It Works/Example:

The FDIC insures up to $100,000 of the following kinds of deposits at FDIC-insured banks and thrifts.

-

Checking accounts (including money market deposit accounts)

-

Savings accounts

-

Certificates of deposit (CDs)

-

Certain retirement accounts on deposit at a bank

Coverage:

The type of account a depositor holds affects the amount of FDIC coverage he or she may have. For example, let's assume you have three separate accounts at Bank XYZ: a checking account holding $10,000, a second checking account holding $50,000, and a $60,000 CD, for a total of $120,000 on deposit.

If the accounts are all single accounts (single accounts are deposit accounts owned by only one person), then the FDIC adds the account balances together and insures the total up to $100,000. In our example, that means $20,000 of your deposits are uninsured.

The situation changes if you hold the accounts jointly with another person. Because the other person has a right to withdraw money from the account, his or her share is separately insured by the FDIC. This means that in our example, your half of the accounts ($120,000/2 = $60,000) would be insured up to $100,000 and the co-owner's half (the other $60,000) would also be insured up to $100,000. No portion of the accounts would go uninsured.

Alternatively, the FDIC insures certain trust accounts up to $100,000 for each qualifying beneficiary (spouses, children, parents, siblings, grandchildren). The coverage applies to beneficiaries who get the account's assets only when the owner dies. Thus, if you held the $120,000 in a trust for your three grandchildren, the full $120,000 would have FDIC insurance because each beneficiary would be insured up to $100,000.

It is important to note that FDIC coverage is $250,000 per depositor in the case of certain retirement accounts. Thus, if your $120,000 were in one or more self-directed retirement accounts, then those account balances would be added together and insured up to $250,000 (leaving no uninsured balance).

Administration:

The FDIC insures the deposits of a bank chartered by a state or federal government. A state-chartered bank has a choice of whether to join the Federal Reserve system; if the bank chooses not to join, the FDIC becomes the bank's primary regulator rather than the Federal Reserve. The FDIC examines and supervises roughly half of the banking institutions in the United States to make sure they are solvent and are complying with banking regulations.

When a bank or thrift institution fails, the bank's chartering authority shuts it down. Then, the FDIC usually sells the deposits and loans of the failed bank to another bank, and the failed bank's customers become customers of the purchasing bank. Usually, customers notice no difference in their accounts, but when a buyer can't be found, the FDIC reimburses depositors for their principal and accrued interest up to the insurance limit. This usually occurs within a few days of the bank's failure.

The FDIC is headquartered in Washington, D.C. and has six regional offices. All five of the FDIC's directors are appointed by the President and confirmed by the Senate. No more than three directors can be from the same political party (this is to provide balance regarding the varying economic views held by the political parties). The FDIC is not funded by taxpayer money; rather, the insurance premiums that banks and thrifts pay for deposit insurance fund the FDIC's operations.

Why It Matters:

The FDIC's job is to maintain public confidence in the U.S. banking system by giving depositors a way out when a bank fails. During the Great Depression, when banks were failing frequently, and there was no deposit insurance, depositors were left with nothing when theIRS banks went belly-up. The mere rumor of a bank having trouble created long lines of panicked depositors eager to withdraw their money just in case. This of course created a self-fulfilling prophecy, because banks make loans with their deposits and hence usually didn't have 100% of those deposits on hand to satisfy nervous customers. According to the FDIC, "No depositor has lost a single cent of insured funds as a result of failure" since FDIC insurance took effect on January 1, 1934.

This is not to say that the FDIC is a catch-all for investors. It is important to understand that the FDIC does not insure stocks, bonds, mutual funds, life insurance policies, annuities, or any other types of investments that bank or thrift institutions may offer. The contents of safe-deposit boxes are also not insured by the FDIC.

For more information about the FDIC, or to use the FDIC's Electronic Deposit Insurance Estimator (to determine whether you have adequate FDIC insurance) visit www.fdic.gov.

_____________________________________________________________________________________________________

INVESTING ANSWERS [http://www.investinganswers.com/node/1340]

_____________________________________________________________________________________________________

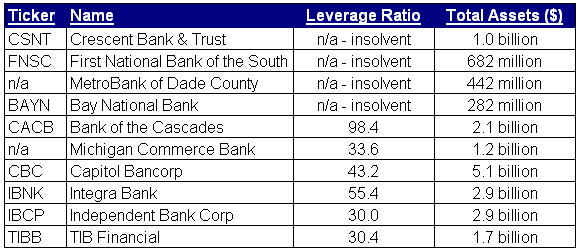

The Next 10 Banks to Fail

Bank failures were all the rage in 2009, with the Federal Deposit Insurance Corporation (FDIC) seizing 140 financial institutions that year. But make no mistake... bank failures are still happening at an alarming rate. The FDIC has already shut down 78 banks, putting us on pace for nearly 200 failures this year.

Even though the U.S. government has decided there will be no more bank failures as large as Lehman Brothers, the smaller local and regional banks are being allowed to slip under the surface without much of a ripple in the headlines.

The list of troubled banks maintained by the FDIC still has over 700 names on it (though the list is confidential). The FDIC has more banks on its trouble list than it has manpower to deal with, slowing down the whole process of closing failing institutions. And because the process is slower and the banks are smaller, the public has been lulled into a state of complacency, with many believing that there's nothing to worry about.

Those people are wrong.

There are plenty of ways to measure a bank's strength. But when it comes down to it, banks that have too little equity compared to their assets are exactly like the homeowner who has too little equity compared to the price of his home. Remember that a bank's assets are the loans it makes to customers. If too many loans go bad for too long, eventually the equity cushion disappears and the bank finds itself underwater.

To find the most vulnerable banks, we look for firms with high financial leverage. In particular, we screen for firms with a total assets/shareholder equity ratio of over 30. To give you some perspective, the average leverage ratio for all FDIC-insured institutions was 9.1 as of the end of 2009. When Lehman failed in 2007, it had a leverage ratio of 30.7.

We have 4 banks on the list that reported more liabilities than assets on their Q1 balance sheets. That makes them officially insolvent, meaning that if you sold all of their assets, you would not be able to cover their debts -- and a bank's debts are your deposits!

We originally posted this article mid-day on May 14th. Within hours, one of the banks on the list, Midwest Bank, was seized by the FDIC. Two weeks later, Bank of Florida was seized, too.

Because your hard-earned savings depend on it, we are committed to updating our list regularly so that you can have the most timely and relevant information at your fingertips.

If you're a depositor, you may want to stop reading this report and hightail it to the teller's window to withdraw your deposits from these walking dead. For planning purposes, note that the FDIC generally shuts down banks after the close of business on Friday in what has become known in the industry as "Bank Failure Friday."

If you insist on remaining a loyal customer of one of these banks, double-check and triple-check that your accounts have less than the $250,000 FDIC-insured limit.

1. Crescent Bank & Trust

As of the end of 2009, Crescent had leverage ratio of 1,365. You are not reading that wrong. The Georgia bank followed up that impressive performance by officially becoming insolvent in Q1 2010, reporting $1 billion in assets and -$12.8 million in owners' equity.

Crescent stock was a day trader favorite in May, trading all the way up to $1.95 from $0.82 in a single day on a message board rumor that its liquidation value was north of $20 per share. With a book value of less than $0 per share today, it's likely that the FDIC will put this firm out of its misery sometime very soon.

2. First National Bank of the South

This Spartanburg, South Carolina-bank has assets of $682 million and negative shareholder equity. It has been deemed by the FDIC to be "critically undercapitalized," with a total risk-based capital ratio of only 4.06 vs. the 8% needed to be "adequately capitalized. Over 20% of its loans are non-performing.

First National has been operating under an FDIC order to improve its capitalization ratios since April 2009. In April 2010, the FDIC closed Beach First, a comparably-sized and critically undercapitalized bank in Myrtle Beach, SC. It's only a matter of time before First National is seized as well.

3. MetroBank of Dade County

We decided to replace Bank of Florida with another failing institution from that neck of the woods. MetroBank's Q1 financial statements show that it is officially insolvent, with $442 million in assets and -$7.6 million in owners' equity.

Interestingly, MetroBank is the only bank on the list with detractors angry enough to start a web site, MetroBankWatch.org. The site's founders seem to be especially angry that "the majority shareholders of MetroBank’s parent company were members of a family that also owns Magic City Casino in Miami – a greyhound track, cardroom, and slot parlor where more than $434 million has been played on slots since October." Unfortunately, whoever the shareholders currently are, they are owners of worthless stock.

4. Bay National Bank

Maryland-based Bay National is currently considered "critically undercapitalized" under FDIC standards. Furthermore, the bank admitted in a filing with the SEC that there's substantial doubt about its ability to continue as a going concern (which is an auditor's term for "this bank is insolvent").

Last week, Bay National also decided to voluntarily delist itself from trading on Nasdaq. It had previously received notice from Nasdaq that the exchange requires listed companies to have positive shareholder equity of at least $2.5 million. With its negative shareholder equity of -$3.6 million, Bay National did not meet that criterion.

5. Bank of the Cascades

Oregon-based Bank of the Cascades posted a $24.4 million loss in the first quarter of 2010. Its financial leverage ratio deteriorated dramatically, too, shoot up to 98.4 from 48.7 in the previous quarter. As of March 31, 2010, it listed $2.1 billion in assets and only $21.2 million in equity.

Cascades has been operating for some time under orders from state and federal regulators to improve its capital position. The FDIC requires banks to have a 10% total risk-based capital ratio to qualify as "well capitalized." Bank of Cascades' ratio started at 7.5 on December 31, 2009 and deteriorated to 6.35 by March 31, 2010.

Cascades did find an investor who tentatively agreed to inject $65 million into the bank, but the investment was contingent on Cascades finding an additional $85 million by May 31st. The bank has been unable to secure the additional investment, and will probably end up in receivership.

6. Michigan Commerce Bank

Michigan Commerce is currently operating under a consent order requiring it to correct "unsafe or unsound banking practices and violations of law rule or regulation." It holds assets of $1.2 billion, but with equity of only $35.7 million, it has a leverage ratio of 33.6.

Michigan Commerce was created last year out of a merger of 11 community banks in Michigan. Its parent company is Capitol Bancorp, a development company that built a nation-wide network of banks that it's now being forced to sell off as it tries to take care of its own undercapitalization.

7. Capitol Bancorp

Speaking of Capitol Bancorp, the parent of Michigan Commerce has problems of its own. Capitol has implemented "capital preservation and balance sheet deleveraging strategies" to help it repair its balance sheet. This means that the bank has been frantically selling subsidiary banks and branches to raise money. It's also attempting a debt for equity swap, which would help bring down its lofty leverage ratio of 43.2.

Capitol is "undercapitalized" according to 1 of the 3 capitalization ratios the FDIC uses to assess bank strength. Unfortunately for Capitol, it continues to lose money as fast as it can replace it with asset sales. In Q1 2010, Capitol reported a net loss of almost $50 million.

8. Integra Bank

Integra had a rough first quarter in 2010, reporting some truly abysmal results:

- 13.3% of its loans are non-performing

- net loss to common shareholders of $54 million

- return on common equity of -1,418.4%

Integra runs about 69 banking centers in Indiana, Kentucky, Illinois and Ohio and it's been busy raising money by selling some of the branches that it acquired during the good times. But shareholder equity continues to erode, falling from $102 million at the end of December 2009 to $52.6 million at the end of March 2010. Its leverage ratio currently stands at 55.4.

9. Independent Bank Corp

Upon reporting first quarter earnings, CEO Michael Magee said, "Our results for the first quarter of 2010 continue to reflect the difficult market conditions we face in Michigan."

Independent reported a net loss of almost $15 million for Q1 2010, which was better than the almost $20 million loss for the quarter ending December 31, 2009. Independent Bank was a recipient of TARP funds in 2008, but failed to pay the dividend on the government-owned preferred shares due on November 2009.

Now, with a leverage ratio of almost 30, Independent is trying to convince investors to exchange preferred shares for common shares. They recently extended the deadline for exchanges, which indicates they did not get the desired response.

10. TIB Financial

TIB Financial, with branches throughout south Florida and the Florida Keys, currently has a leverage ratio of 30.4. TIB issued a press release in April saying that as of March 31, 2010 it was adequately capitalized for regulatory purposes. Technically, it's true. For example, TIB's total capital to risk-weighted assets ratio is 8.1%, and the FDIC's standard for "adequate capitalization" is 8%. But for a bank to be considered "well-capitalized" the FDIC wants it to have a risk-weighted asset ratio of 10%.

TIB has been meeting with private equity firm, Patriot Financial Partners, in what may be its last chance to raise capital. Patriot has committed $20-25 million, but only if TIB can raise an additional $120-125 can be raised from other investors.

Watch List: Sonoma Valley Bank

We moved Sonoma Valley off the projected failure list and on to our watch list because the FDIC just gave it an extension until August 15th to improve its financial health. With capital ratios well below the FDIC's all-important "adequately capitalized threshold," Sonoma Valley needs to find someone to inject $20 million in additional capital if it has any chance of getting back into compliance.

Though the FDIC could technically still seize Sonoma Valley despite the extension, we believe that the overburdened agency will take the next few months to target banks that are in even worse shape than Sonoma Valley.

Watch List: Sterling Financial

Sterling was also moved off the potential failure list and onto the watch list. The Spokane-based bank is negotiating and making progress with private equity firms Thomas H. Lee Partners and Warburg Pincus regarding a combined $278 million investment in the bank.

If it can convince the U.S. government to convert its $303 million of preferred stock to common stock, then it will only need $139 million more to meet its goal of a $720 million capital infusion.

As of the end of 2009, Sterling's leverage ratio was hovering around 32.8. It posted a Q1 2010 net loss of almost $79 million when it was forced to set aside $85 million for potentially bad loans. If its financing plans start to fall apart, we will place Sterling back on the list of banks likely to end up in receivership.

_____________________________________________________________________________________________________

Last updated on 05/08/2011